The initial reaction will almost certainly be shock "What??? They cut by how much??" However, after a few minutes of reflection, a second more dangerous thought takes hold. Perhaps, the US economy is diving into a deeper recession than originally thought. After all, why does the Fed feel the need to cut so aggressively? Shock will be quickly replaced by concern.

Looking beyond a 24 hour horizon, it is hard to see how this cut could help much. Adjusted for inflation, fed rates are now negative. US inflation is accelerating, and reducing rates can only weaken the dollar, which is not exactly a recipe from price stability

The Fed appears to be, for all practical purposes, unconcerned about inflation. This will ultimately begin to affect inflationary expectations. Over the longer term, the Fed could be reviving the reputation it had from the 1970s. When it come to inflation, the Fed is a weak and accommodating central bank.

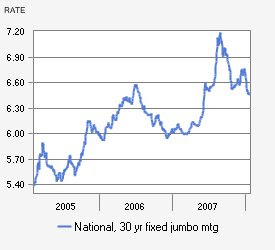

Although the Fed's amateur dramatics will grab headlines, the US housing market is extremely unlikely to benefit much from this cut. According to bankrate.com, the 30 fixed rate jumbo mortgage interest rate is 6.5 percent, which is approximately the same level it was at in mid-2007. After record sub-prime losses, US banks have significantly tightened their lending criteria. The days of easy mortgage credit are gone and will not return any time soon.

Likewise, consumer credit is unlikely become cheaper either. This largely reflects a growing concern about the capacity of US consumers to repay their loans. Banks are anxious to reduce exposure, while Wall Street isn't in any shape to repackage this debt and lift it from bank balance sheets. Currently, credit card rates average between 10-14 percent. These are not the type of rates that would encourage a recession-avoiding spending spree.

This recession was booked and paid for three years ago. The US housing bubble created massive macroeconomic imbalances that could only be resolved by an economic slowdown. Rising inflation has eroded the incentive to save. Personal household balance sheets are overloaded with debt. The current account deficit is unsustainable. Lending standards have been too lax, and pushed the financial sector to the brink of crisis. Another round of easy fed money does nothing to solve these problems.

It would have been better if the clown had remained in the wardrobe.

7 comments:

I think the gravy train that has been trundling along for the last decade or so has finally hit the buffers.

Even if the BOE and FED reduce interest rates dramatically, there is no way that it will make up for people living way above their means for all that time.

People (and the country as a whole) are already up to their necks in debt and I think the appetite to get deeper in debt has gone.

Sorry to say this folks, but recession and a BIG correction in property prices is now inevitable.

p.s. Gordon Brown still thinks the UK has a strong economy... Mr Bean for sure eh !

FED = Best central bank wall street can buy

I can't wait to see what magic trick Bernanke will pull out of his arse to save the day again when the markets forget all about this little stunt and resume their downward trajectory in another day or two.

the rate cut is somewhat symptomatic of the CNBC internet trader NOW culture.

Cue joke about premature you know what!

IMO the US is heading downhill much faster than most realise, these guys can see the data in real time and have big flash screens like in the movies and you can't spit without hitting a PHD or ex exec's, they also have the inside info on the big Investment Banks (insolvent). I don't think inflation is a problem when you have systemic failure, its like worrying about a small graze when you have lost your leg.

rumours abound about citi going chapter 11. eeek!

"After all, why does the Fed feel the need to cut so aggressively? Shock will be quickly replaced by concern."

What price the exchange rate of the US$?

With the rate cut all but an admission that the US economy is not as robust as they have been saying, they are stuck between a rock of a bombing domestic economy and the hard place of a US$ crisis.

Neither will be very nice, the US and the US$ has benefited from being the so called global reserve currency, when the exchange rate starts to really go down, the Chineese and Europeans will find themselves in a race to unload their US$ reserves before they find they are only good for keeping warm by.

Repent! The end of the world is nigh!

Post a Comment